I led the transformation of Lloyds Business Bank's onboarding process, delivering a mobile-first platform that enables new customers to onboard in record time, reducing the previous 28-day account opening process to just 2 days.

Year

2023

Lloyds Banking Group

Client

Industry

Financial Services

Product Design

Contribution

Challenges Faced:

Lloyds Business Bank encountered several hurdles in their onboarding journey, including reliance on manual processes, lack of cross-selling opportunities, and complexities in complying with consumer duty legislation and risk factors.

Solution Implemented:

We embarked on a comprehensive overhaul, introducing a streamlined, mobile-first platform designed to cater specifically to sole traders.

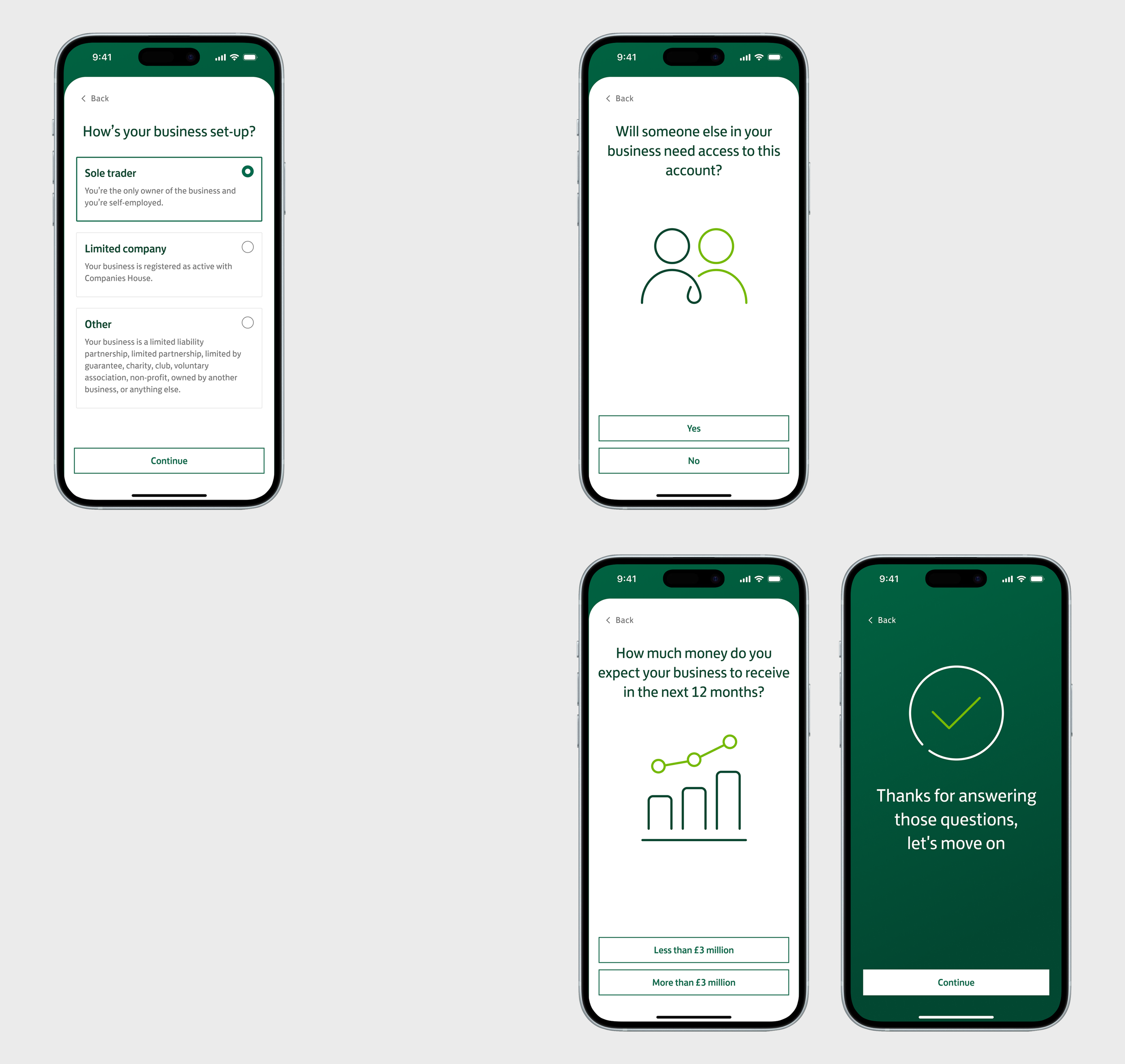

Through meticulous customer research, we identified pain points and restructured the journey into five intuitive steps: Eligibility → Know Your Customer → Know Your Business → Document Upload → App Tracker

In some exceptions, after applying, a customer might be asked to provide more information or even upload additional documents.

Enhanced User Experience:

Our challenger-like approach reduced nearly 30% of the questions, prioritising practicality and ease of use for bank customers.

Seamless Integration:

We seamlessly integrated merchant service solutions, photo ID capture, and document upload, enhancing fraud protection and liveness checks. These improvements led to an overall enhancement in quality and application time.

Merchant service solution

Liveness checks